One of your best assets if you are reading this and you are under 50 is time. If you are not in that group, besides cursing me, you may be wondering if you have no options to improve your finances. Of course you do, without a doubt. But the type of investments that will suit you and your patience, will be different.

If this is your first contact with personal finance, I recommend starting with the simplest things. I gave you some initial advice in previous posts . In this post, I will talk about two actions you can take NOW to start doing better and make good use of the time I mentioned.

The path to wealth depends primarily on two words: work and savings.

Benjamin Franklin

Direct deposit your paycheck

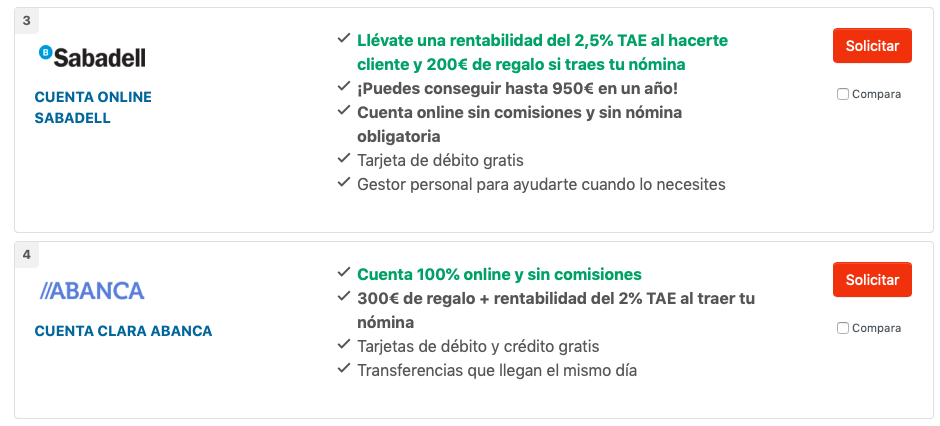

I know that changing banks is something that usually causes laziness, fear, or both. But plan it and get down to work. It's an action that can give you a little extra income that you can save or use to buy what you need. Right now (May 2023), Abanca, for example, is offering 300€ for bringing your paycheck and a return of 2% TAE and Sabadell bank offers 300€ and 2,5% TAE in their salary account.

The most important thing when it comes to direct depositing your paycheck is to know the requirements of different banks:

- Contract's duration .

- Minimum amount, if any, of your monthly paycheck

- The associated costs they charge you for maintaining your account

- If a debit or credit card is included for free or under which circumstances

Once you have the list of different offers in the market, choose the one that best suits you. There are several websites that save you the work of searching the offers bank by bank. The one I usually consult is helpmycash website. They list the different offers for salary accounts, rate them, and update them monthly.

What I do is, once I have completed the process, I write down all the conditions and requirements in my budget Excel file. Additionally, I set a reminder on my mobile calendar that alerts me when the commitment period is over. Therefore, when there are a few weeks left, I start looking for the next destination for my paycheck.

Start saving for the long term

I will talk to you about different types of investments in the following finance posts, but for today, we will start with SIALP.

El SIALP or Individual Long-Term Savings Plan is an excellent tool to start saving. As its name suggests, it is designed to work in the long term, so we should be able to do without the money we put into it for at least 5 years.

The Spanish government wants to encourage this type of instrument and therefore, one of its advantages is that from 5 years after its opening,, you will not have to pay any taxes if you want to withdraw what you have invested. Each person can only have one active SIALP.

The majority of banks work with insurers that offer this type of product. Each one, again, with its own incentives to get you to choose theirs. It comes with a life insurance policy and usually includes a final bonus. That is, if you manage to meet the proposed investment period (20, 30 or 40 years), you will receive a bonus.

The truth is that, if they do not have an associated bonus, the yield of these types of products is limited. However, I think it is a good starting point for starting to save. What I do is deposit €50 per month and it works for me as a savings account with a small interest. The key is that I was able to join a campaign with an interesting final bonus. It is worth noting that only the first €5,000 per year are exempt from taxes. Since I only deposit €600 per year, I have plenty of leeway.

Never stop learning

In the world of finance, especially if you've never had any previous training in this field, you must always be open to discovery. In addition, you must put your ego aside, since it is impossible to know all the ins and outs and, worse yet, to know what will happen. That is why you should diversify your strategy and always be willing to learn.

It doesn't matter at all if you're right or wrong. What matters is how much you win when you're right and how much you lose when you're wrong.

George Soros

I hope that with these two ideas, you start saving and manage to improve your financial health. In the next post, I will talk to you about index funds..

See you soon and happy reading!

Leave a Reply